The Custom Private Equity Asset Managers Diaries

In Europe - an even more fragmented market - the correlation in between acquistion funds and public equity is far reduced in the same amount of time, occasionally adverse. Considering that exclusive equity funds have even more control in the business that they purchase, they can make a lot more active choices to react to market cycles, whether approaching a boom period or an economic crisis.

In the sub-section 'Exactly how private equity impacts portfolio returns' above, we saw just how consisting of exclusive equity in a sample profile boosted the general return while also enhancing the overall threat. That said, if we consider the same kind of instance placed in different ways, we can see that consisting of private equity enhances the return overmuch to enhancing the threat.

For illustratory purposes only. Source: Evestment, since June 2019. These hypothetical profiles are not planned to represent profiles that an investor necessarily would have had the ability to construct. The standard 60/40 portfolio of equity and fixed revenue properties had a danger degree of 9. 4%, over a return of 8.

Rumored Buzz on Custom Private Equity Asset Managers

By including an appropriation to personal equity, the sample portfolio risk enhanced to 11. 1% - but the return additionally increased to the exact same figure. This is just an example based upon an academic profile, yet it demonstrates how it is possible to use private equity allocation to branch out a portfolio and enable for greater inflection of threat and return.

Moonfare does not offer investment suggestions. You should not interpret any kind of details or various other material supplied as lawful, tax, investment, monetary, or various other recommendations.

A link to this data will be sent to the following email address: If you want to send this to a various read the full info here e-mail address, Please click right here then click the link once again.

Our Custom Private Equity Asset Managers Ideas

Shareholders are no much longer running the service. Representatives (in this situation, supervisors) might make choices that benefit themselves, and not their principals (in this instance, owners).

Competitors have far better products and reduced prices. The firm endures, however it comes to be bloated and sclerotic. The sources it is usinglabor, resources and physical stuffcould be utilized much better elsewhere, but they are stuck due to inertia and some recurring goodwill. Culture is poorer because its limited resources are caught in operation worth much less than their capacity.

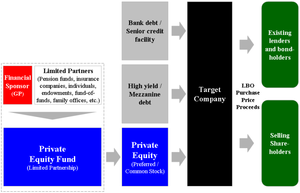

In the regular exclusive equity investment, a mutual fund utilizes cash elevated from wealthy individuals, pension plan funds and endowments of colleges and charities to buy the company. The fund borrows money from a financial institution, making use of the properties of the company as security. It takes control of the equity from the dispersed shareholders, returning the company to the place where it was when it was foundedmanagers as proprietors, instead of agents.

Getting The Custom Private Equity Asset Managers To Work

The personal equity fund installs administration with often times that risk. Chief executive officers of personal equity-funded business routinely get five percent of the firm, with the administration team owning as a lot as 15 percent. The fund has all the rest. Again, the ton of money of the company are connected with the ton of money of the managers.

In this way, the worth of personal equity is an iceberg. Minority firms that are taken personal every year, and the excess returns they make, are the little bit above the water: big and vital, however hardly the whole tale. The gigantic mass below the surface area is the firms that have far better management as a result of the risk of being taken control of (and the administration ousted and changed by personal equity execs).

Companies aresometimes most effective when they are personal, and sometimes when they are public. All firms start out private, and lots of expand to the point where offering shares to the public makes sense, as it permits them to lower their expense of funding.

Examine This Report on Custom Private Equity Asset Managers

The doors of capital must turn both methods. Personal equity funds supply a very useful solution by completing markets and letting firms maximize their worth in all states of the globe. Takeovers do not constantly function. While personal equity-backed companies outmatch their exclusive market rivals and, research studies show, carry out far better on employee safety and various other non-monetary dimensions, often they take on as well much financial obligation and die.

Bad guys in organization motion pictures are commonly investment types, instead of builders of points. Before he was retrieved by the woman of the street with the heart of gold, Richard Gere's personality in Pretty Lady was a private equity guy. He decided to build boats, rather of purchasing and breaking up firms.

American culture devotes significant resources to the private equity sector, but the return is paid back many-fold by boosting the productivity of every company. We all advantage from that.

The Main Principles Of Custom Private Equity Asset Managers

Newsweek is committed to difficult standard knowledge and searching for links in the search for typical ground. Private Investment Opportunities.

"Furthermore, we additionally found adverse effects on other steps of client wellness. Scores on movement, abscess, and pain. We discover a meaningful, constant image of people doing even worse after the nursing home is purchased by private equity. We also see evidence that the nursing home spending rises for Medicare by around 6-8%." Werner explained that researches of assisted living facility throughout the COVID-19 pandemic discovered that personal equity-managed institutions fared better than taking care of homes that weren't associated with personal equity at the time.